Getting into cryptocurrency trading might seem daunting for a beginner but it can be easy with the right tips. It is important to have a general understanding of how the industry works to better trade in different cryptocurrencies.

As a beginner one should be ready to learn as much as possible in order to apply it when they start trading in Bitcoin and altcoins. There are many advantages of cryptocurrency that range from investment to cashless payments. In this article, we will mention some tips and tricks that can help a beginner succeed as a crypto trader.

Only Trust Reputable Sources

There is a culture of misinformation on the internet which is why one should only trust reputable news sources. Different sources will show different opinions about cryptocurrencies and how they should be traded. Many sources will also show the opinion of cryptocurrency is being a passing fad that will only lead to disappointment.

However, as a trader and investor, it is in your hands to believe what you hear. If you have already decided to trade in cryptocurrencies, try not to get influenced by opinions that deter you from investing. Good platforms like cryptoengine.app work to show you the latest trends which might help in investing later.

If you have already made up your mind, the right sources can benefit you to a great extent. Only stick with reputable channels or news outlets that provide relevant information. If you want to be a successful Bitcoin or altcoin trader try not to be influenced by random opinions.

Be On Your Toes

It is very important to be vigilant about how and when you are trading a particular cryptocurrency. The platform and security issues are directly related to whether you can sustain a profit or a loss during a trade.

It is important to take care of the amount you are investing in a particular cryptocurrency and how it is being traded. The best way to be vigilant will be to look at the security measures of different trading platforms and mobile wallets.

Understanding the risks of trading are also important for beginners so that they can manage digital assets easily. One has to be vigilant about the vulnerability that exists during the trade so that they can make the right investment decisions and handle the cryptocurrencies responsibly.

Get Ready for Volatility

It is very important to understand the level of volatility any investment is prone to in crypto trading. Cryptocurrency is very different from Fiat currency and is not at all stable in comparison. Its experience is highs and lows at a very drastic level which makes it largely unpredictable and very volatile.

Even the most stable cryptocurrency, Bitcoin, sees unusual highs and lows. As a beginner it is very important to understand the extent to which price volatility can damage your investment and trading practices. It is important to only invest when you are ready for that commitment.

Being too greedy with the cryptocurrencies would lead to big losses that might be difficult to cover. As a beginner, you might want to prepare for volatile changes but there is little you can do about it. Even experienced traders might not be able to help you out with truly understanding price volatility. It is very important to understand the risk of investing when you get into trading.

Don’t Be Stuck at Bitcoin

We understand that Bitcoin is the most popular cryptocurrency and holds the largest market share. It is easy to be influenced by the numbers and feel that investing in Bitcoin might help you out. But just because you choose Bitcoin does not mean that you should ignore other cryptocurrencies.

Venture into different altcoins like Ethereum as it will diversify your investment portfolio. Any experienced trader will ask you to consider trading other altcoins along with Bitcoin to manage losses. Investing in multiple currencies is a good strategy for staying afloat in case one of them tanks.

The best approach for a beginning trader would be to invest in the five cryptocurrencies that have the largest market share or show comparatively the most stability. The idea is to spread out the investment to increase benefit. So try to invest in different bitcoins so that you can maximize profit and minimize loss.

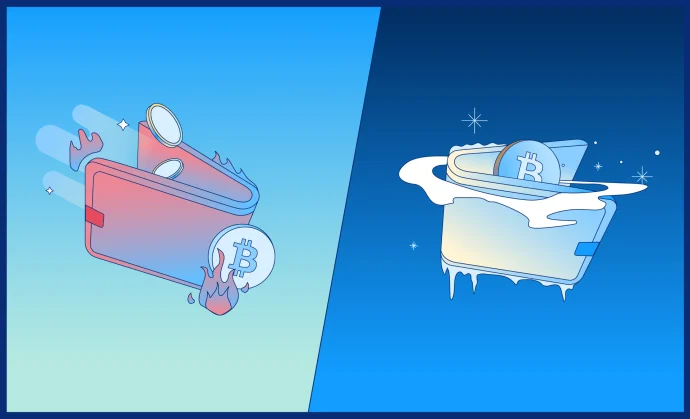

Fluctuate Between Hot and Cold Wallets

Since you will be trading cryptocurrency it is very important to understand how hot and cold wallets work. Usually with crypto investments, one has to be in it for the long haul. This means that much of the digital currency that you own will be stored in a cold wallet which is specifically meant to keep it protected from malicious attacks.

Cold wallets are meant for long term storage and it is recommended to only switch to hot wallets when it is time to trade any particular currency. There are many platforms available that offer wallets and it is better to have different wallets for different cryptocurrencies. Hot wallets are comparatively more versatile than cold wallets and will be used extensively for trading purposes.

On the other hand, experienced traders will recommend that you keep most of your digital currencies stored in cold wallets when you are not trading with them. The best approach in this case will be to know the basic details of operating both hot and cold wallets.

The Takeaway

A beginner who is interested in trading will know a lot about cryptocurrency and understand how well they need to manage their digital assets to maximize their profit. It is important to only trust reliable sources and be vigilant about the platform and security measures. The volatility along with security concerns are big risks to look into.

Being vigilant will allow any beginner to succeed as a crypto trader because they will be able to analyze the market trends better. Price volatility is a given risk across Bitcoin and different altcoins so it is better to diversify the portfolio.